BLUF: In the military, credit cards can be your friend – like a rich friend who gives you awesome stuff for free. But you have to be smart about it.

How to be smart about it:

- Never, ever, carry a balance

- Set up autopay so you never, ever carry a balance

- Collect signup bonuses, through natural spend

- Don’t spend more than you otherwise would just for a SUB

- Get your spouse involved to double or triple the bennies

- Use different cards for different things to get the most useful benefits for you

- Have a plan for which cards you want to keep when you get out

Background: The magic behind credit card rewards

It’s not really magic. Every time you swipe a credit card, the merchant pays a transaction fee to the bank that issued the credit card. The bank kicks some of that back to you, in one of several different forms – cashback, reward points, annual credits or other perks. A lot of the rewards play off gaming psychology and a whole industry has spring up to teach people how to accrue and maximize credit card reward. Like, for example, Military Finance Blog.

What’s the catch?

There’s no catch, or at least there doesn’t have to be. These cards have very high interest rates (on the order of 25% a year) so if you aren’t living by the Golden Rule of Credit Cards, you’ll pay waaaaay more in interest and fees than you’d ever gain in signup bonuses and rewards. Oh and you’ll tank your credit score along the way.

THE GOLDEN RULE OF CREDIT CARDS

Always, Always, Always Pay Off Your Balance In Full Every Month

If you pay off your statement balance in full every month, you won’t pay a penny in interest. Set up an autopay so that you’re covered when you inevitably forget that your payment is due. Be honest with yourself, you’re not going to remember to manually pay your card off when you’re deployed in the field. and when you’re out there, the last thing you need is another source of stress.

No, but really, what’s the catch?

Normally, the fancy credit cards that give you lots of sweet benefits also come with hefty annual fees. Thanks to a few banks’ generous application of the Military Lending Act (MLA) and Servicemembers’ Relief Act (SCRA) military members don’t need to worry about those annual fees. These laws limit things like the interest rate or fees that banks can charge service men and women. Whether out of fear of violating these laws or feeling generous toward men and women in uniform, some banks will entirely waive the annual fees for personal credit cards. Those banks are American Express, Chase, Citi, and US Bank. Capital One does something similar but only for credit cards taken out before you joined the service. Bank of America has mixed reviews, but multiple data points indicate they will waive all but $100 in annual fees.

| Card Issuer | Annual Fee waived under MLA? | |

| AMEX | Yes | Personal cards only |

| Bank of America | Maybe | Datapoints suggest reducing annual fees down to $100, but customer service has been inconsistent on answering their military fee policy |

| Barclays | No | Does not waive annual fees |

| Capital One | No | Waived under SCRA only (meaning you had the CC before entering service) |

| Chase | Yes | Personal cards only |

| Citi | Yes | Must email a copy of orders to: militaryorders@citi.com to request benefits |

| US Bank | Yes | Personal cards only |

Okay, where should I start?

Check out this article about the MLA database. It will show you how to use the same database that the credit card companies use to check that you are active duty. Active duty in this case also applies to reservists on orders >30 days. Check to see that you’re in the MLA database before applying for any credit card. If you’re there, you can go right ahead and apply. There isn’t a separate military application or portal or anything like that, just apply right on the credit card company’s website.

What sort of credit score do I need?

You will need what is considered a “good” credit score – something north of 670. If you are just starting out or don’t have any debt (that’s a good thing!) you can start building credit with smaller introductory credit cards. Your first port of call should be checking your credit score so you know what you are working with. Annualcreditreport.com is a 100% free site established by federal law that allows you to check your credit report. More importantly they won’t try to sell you anything.

Most credit card companies will do a “hard pull” to check your credit. Each bank uses different credit monitoring companies so if you have your credit frozen (meaning you don’t allow lenders to check it, to reduce the risk of identity theft), keep that in mind. You will have to unfreeze or “thaw” your credit with the corresponding agency (Transunion, Equifax, or Experian). Even if you are military, you need to meet the income and credit requirements for each card.

How about my spouse?

If you are married, congratulations you have a “player two” in the game of credit card rewards. You can get a signup bonus, refer your spouse and get a referral bonus, and then your spouse can get the signup bonus. You can also use your combined household income on the application. That means that if you have a stay at home spouse they can list your income to help them qualify for these premium credit cards. Many applications ask occupation and if you have any tax free income so remember BAH and BAS are tax free!

You said something about signup bonuses?

This is where you make the real money. Credit cards are most generous at the start when they want to get you to sign up. But you usually only get the full signup bonus after hitting some minimum spend. You can sign up for (almost) as many premium credit cards as you want but time the applications around big purchases so you naturally spend enough to get the big rewards. You may have to get creative – like picking up the tab when your group of friends goes out and having them pay you back. But don’t spend more than you otherwise would just to get a signup bonus. It’s not worth it. Also, it has to be legit spending. Back in the day people used to just buy gift cards to manufacture spending but the credit card companies have caught on to that.

What are all the possible cards I can get?

| Credit Card | Cost (the annual fee) | Benefit(the biggest bennie) |

|---|

American Express

| Platinum | $695 | Centurion lounges, $15/mo Uber credit, $20/mo streaming services credit |

| Platinum Card for Schwab | $695 | Same as normal platinum; convert Membership Reward points at a value of 1:1.1 to your Schwab balance |

| Gold | $325 | 4x points on restaurants and groceries. $10/mo uber cash, $10/mo dining credit |

| Green | $150 | 3x points on restaurants and “transit” |

| Marriott Bonvoy Bevy | $250 | Marriott Gold Elite status. 15 night elite credit per year |

| Marriott Bonvoy Brilliant | $650 | Marriott Platinum Elite status. Free annual marriot hotel stay (up to 85k points). $25/mo dining credit. 25 night elite credit per year. |

| Delta SkyMiles Reserve | $650 | Delta companion certificate. Delta sky club access (15/yr). $20/mo Resy credit. $10/mo rideshare credit. |

| Delta SkyMiles Platinum | $350 | Delta companion certificate. First checked bag free |

| Delta SkyMiles Gold | $150 | First checked bag free. |

| Blue Cash Preferred | $95 | 6% cashback on groceries, and streaming services. 3% cashback on gas and transit |

| Hilton Honors Aspire | $550 | Hilton diamond status. Hilton annual free night. $400/yr Hilton resort credit. $200/yr flight credit |

| Hilton Honors Surpass | $150 | Hilton gold status. |

U.S. Bank

| Altitude Reserve Infinite Visa | Closed to new applicants 11/11/24 $400 | $325/yr travel credit. 3x points on mobile wallet spending |

Bank of America

| Bank of America Premium Rewards Elite | $550 | $300/yr airline incidental credit. $150/yr credit for streaming/food delivery services. Priority pass |

Chase

| Sapphire Preferred | $95 | $50/yr hotel credit. 2x points on travel, 3x on dining |

| Chase Sapphire Reserve | $550 | $300/yr travel credit. Sapphire lounge access and priority pass. 3x points on travel and dining. |

| Southwest Rapid Rewards Plus | $69 | 2 early bird check in per year. 3k anniversary points per year |

| Southwest Rapid Rewards Priority Credit | $149 | $75/yr annual southwest travel credit. 4 upgraded boardings per year. 7.5k anniversary points per year |

| United Explorer | $95 | One free checked bag. 2x united club passes per year, pre-check fee credit |

| United Quest | $250 | Two free checked bags. $125/yr united purchase credit |

| United Club Infinite | $525 | Two free checked bags. United club membership. Premier access. IHG platinum elite status |

| Aeroplan | $95 | Aeroplan 25k status. One free checked bag. TSA precheck credit. |

| Marriott Bonvoy Boundless | $95 | Marriott annual free night (35k pts). Marriott silver elite status |

| Marriott Bonvoy Bountiful | $250 | Marriott annual free night (50k pts). Marriott gold elite status (15 night credit annually). |

| Ritz Carlton | Not accepting applications$450 | Marriott annual free night (85k pts). Marriott gold elite status (15 night credit annually). $300 airline credit annually. 3 Ritz Carlton club upgrades/yr. |

| IHG One Rewards Premier | $99 | IHG platinum elite status. Annual IHG free night. $50/yr United credit |

| World of Hyatt | $95 | Hyatt annual night (cat 1-4). Hyatt discoverist status (5 night credit annually). |

| Disney Premier Visa | $49 | 10% disney discount on some things. Disney card design |

| British Airways Visa Signature | $95 | 10% off BA flights. Up to $600/annual flight credit on reward travel. |

| Aer Lingus Visa Signature | $95 | Priority boarding on Aer Lingus flights. |

| Iberia Visa Signature | $95 | 10% airfare discount |

Citi

| AAdvantage Platinum Select World Elite Mastercard | $99 | One free checked bag. Preferred boarding on American Airlines |

| Citi / AAdvantage Executive World Elite Mastercard | $595 | Admirals club membership. $10/mo Grubhub credit. $120/yr Avis or Budget rental car credit. First checked bag free. TSA precheck credit |

| Citi Strata Premier | $95 | $100/yr hotel credit (on $500 spend). 3x pts on travel and dining. |

That’s a lot. Which cards do you recommend?

Some of our favorites are: Chase Sapphire Reserve, American Express Gold, American Express Platinum, and the premium credit card for whichever hotel chain or airline you find yourself using most.

Will having so many credit cards hurt my credit score?

Mismanaging any number of credit cards will tank your credit score. But if you adhere to The Golden Rule of Credit Cards, having more available credit that you manage responsibly will actually increase your credit score over time. A “hard” credit inquiry, like what companies pull when you apply for a credit card will temporarily lower your credit score but it will come back up with time and as you use the new credit responsibly.

Now let’s talk strategy

Due to varying rules among banks, there is a correct order to go about applying for these cards. Here are some of the things you have to watch out for:

Chase prohibits you from applying for a new credit card if you have applied to more than 5 cards in the past 24 months. That’s not 5 cards from Chase, that’s 5 cards total in the last 2 years.

American Express has rules that preclude you from getting a signup bonus for a lower tier card if you have already gotten a signup bonus for a higher tier card in the same “family”. So, for instance, you can’t get a signup bonus for a Gold card if you have already gotten a SUB for a Platinum card. But you can get a signup bonus for a Platinum card even if you have already gotten a SUB for a Gold card.

Bank of America has mixed reviews. Multiple reports indicate that they will waive all but $100 in credit card annual fee. Their military help line has given inconsistent answers with how they apply military fee waivers.

Always have a plan. Don’t just jump into the card churning game because someone in your ward room told you about all the sweet points he was getting. Ultimately, it comes down to how many credit cards you plan to get and how long you plan to spend in the military. Let’s say you plan to be in for another 3 years or more and want to have 5 cards. A good flow would look like this:

- Chase Sapphire Reserve

- AMEX Gold

- AMEX Platinum

- Premium hotel card

- Premium airline card

Airline & hotel cards

Airline and hotel partner cards aren’t as flashy as some of the premium cards like AMEX Platinum or Chase Sapphire Reserve but they may be some of the most useful. Say you’re going on a TDY and staying in a Marriott, if you have the AMEX Marriott Bonvoy Brilliant card you would get free breakfast and lounge access thanks to the Bonvoy platinum elite status that comes with the card. A lot of the airline and hotel cards have no foreign transaction fees which can save you a lot when travelling since those are generally flat fees that apply to even small purchases in different currencies. Many of the airline cards offer free rental car insurance so you don’t get ripped off at the rental counter. As always, terms and conditions apply.

Here are the top cards for each major airline and hotel group:

| Brand | Premier Credit Card | Top Benefits |

| Marriott | AMEX Marriott Bonvoy Brilliant | Marriott platinum elite status (free breakfast and lounge access). Free 85k annual night. |

| Hilton | AMEX Hilton Honors Aspire | Hilton diamond status (highest tier) – free breakfast |

| IHG | IHG One Rewards Premier | IHG platinum elite status. Annual IHG free night. $50/yr United credit |

| Hyatt | World of Hyatt | Hyatt annual night (cat 1-4). Hyatt discoverist status (5 night credit annually). |

| United Airlines | United Club Infinite | Two free checked bags. United club membership. Premier access. IHG platinum elite status |

| American Airlines | Citi / AAdvantage Executive World Elite Mastercard | Admirals club membership. $10/mo Grubhub credit. $120/yr Avis or Budget rental car credit. First checked bag free. TSA precheck credit |

| Delta Airlines | Delta SkyMiles Reserve | Delta companion certificate. Delta sky club access (15/yr). $20/mo Resy credit. $10/mo rideshare credit. |

| Southwest Airlines | Southwest Rapid Rewards Priority Credit | $75/yr annual southwest travel credit. 4 upgraded boardings per year. 7.5k anniversary points per year |

| Hawaiian Airlines | Bank of America only waives fees above $100 | |

| Alaska Airlines | Barclays does not waive annual fees on credit cards | |

| JetBlue Airlines | Barclays does not waive annual fees on credit cards |

AMEX Pop up jail

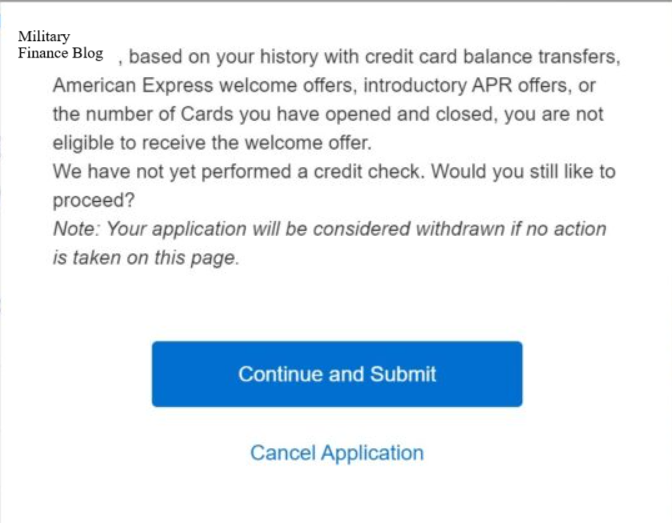

Another thing to watch out for is American Express “pop up jail” that’s when you’re applying for an AMEX card and you get a message that looks like this:

You can still apply for the card but the pop up message breaks the bad news that, even if you’re approved for the card, you’re not eligible to get the signup bonus. They use this to combat “churning” or getting a card just for the signup bonus without intending to use it for anything else.

AMEX hasn’t officially said what causes this. It could be changes to your credit or past evidence of churning. It seems like it mostly happens when you have other AMEX cards that aren’t really used and don’t have routine charges. A proven method to get around the dreaded pop up is to start putting more spend on ALL of your open AMEX cards, even if only a little. Do that for a bit and then complete the application again and reapply. When this happened to me, I waited a couple weeks before reapplying and then it was approved.

I have all these cards, now what?

It’s worth reading the fine print. Each card will generally give you extra rewards for some category of spend – travel, groceries, hotels, gas stations, etc. And those rewards and categories can change so it pays to check back somewhat frequently. Also think about what rewards are most valuable to you. Generally, cash is king but if you’re planning a vacation, airline or hotel rewards may mean more to you right then.

What do I do when I leave the service?

Like all good things, the sweet MLA fee waiver will come to an end. Data Points vary on how long after leaving the military that the annual fees start coming. Some say that it takes a month, some claim that years later they are still not paying. But I’d plan on getting charged annual fees sooner rather than later and if we’re talking about premium cards, those fees can be north of $500 /year /card. That means you should have a plan before you start applying for all these premium cards, even if you think you’ll be in for the next 20 years. If you’re able to leave the service and go directly to a job where you don’t mind paying a couple grand a year in credit card fees, congratulations, but the rest of us will have to make some choices.

Something to keep in mind is that, maybe counterintuitively, when you close a credit card account it will usually negatively affect your credit score. That is because you will then have less credit available and often a shorter credit history. Now imagine the effect from closing 20+ cards if you were an ultra mega churner while you were on active duty.

A few exit strategies exist:

- Join the reserves or National Guard: if you plan to affiliate with the reserves or guard you are probably fine keeping the cards as long as you take orders >30 days. This is the threshold they use to qualify as active and if it hits, you can get the fee waived by sending in a copy of your orders.

- Downgrade: you can keep the lines of credit open but change to a no annual fee credit card, thus avoiding the hit to your credit from cancellation. For example downgrading the Chase Sapphire Reserve to the Chase Freedom Unlimited card or the Chase Freedom Flex card, both of which have no annual fee.

- Close em’: maybe you close some but not all or maybe you are financially free in your paid off dream home. If you don’t plan to use credit or make a big purchase (like a home mortgage) in the foreseeable future maybe you’re okay with taking the hit to your credit.

Downgrade options:

| Premium (high annual fee) card | Downgrade options |

| AMEX platinum | AMEX green card ($150/yr) |

| Chase Sapphire Reserve | Sapphire Preferred ($95/yr) or Chase Freedom Flex (free) or Chase Freedom Unlimited (free) |

| AMEX Delta Reserve card | Delta Blue card (Free), Delta Gold card ($150/yr), or Delta Platinum card ($350/yr) |

| AMEX Hilton Honors Aspire | Hilton Surpass card ($150/yr) or Hilton Honors card (free) |

| United Club Infinite | United Quest card ($250/yr) or United Explorer card ($95/yr) |

To downgrade or cancel, start by calling the number on the back of your card or reaching out to the company on their online portal. Before you downgrade or cancel it is worth asking if there are any retention offers available to you to see if it is worth your while to keep the card open. To downgrade you will usually have to have the card open for 12 months and the company usually prorates any annual fees that were paid. Keep in mind, some banks only let you upgrade or downgrade to cards in the same “family” and you are usually making yourself ineligible for any future signup bonuses on the card product you change to. Other cards don’t have a free annual fee downgrade option so be prepared to cancel those cards or fork over the annual fee amount.

Begin with the end in mind

There are two big takeaways here: you can absolutely get a lot of great benefits from credit cards but you have to keep on top of it. If you miss on monthly payment, you could lose all the benefits you have banked up to that point. And you won’t really come out ahead if you live it up on points while you’re in the service but tank your credit as soon as you get out and want to settle down and buy a home. Nothing is free – either you pay in dollars or in time and attention. But if you know what to watch out for and start with a solid plan, you can live a lot better. That’s why we’re here.

It may seem a little tricky but you can do it.