Bottom line

The Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA) are two laws that can make a meaningful difference to your financial situation if you are active duty or on active duty orders. The SCRA caps the interest rate you pay on most loans while you’re on active duty and allows you to break residential and cell phone leases if you move or get deployed. The MLA, in the way some banks apply it, allows you to get premium travel credit cards (which include annual credits, elite travel status, and lucrative sign up bonuses) completely free for you and your spouse.

The gouge

The Servicemembers Civil Relief Act has got your back (financially)

- Allows you to break a phone contract, car lease or residential lease penalty free if you PCS or deploy

- Caps the interest rate on mortgages, student loans (taken after 2008), car loans, credit cards, and personal loans taken out prior to active duty at 6%

- Allows you to remain a legal resident if you move due to military orders, which can mean big tax savings if you have been stationed in a no-tax or low-tax state

The Military Lending Act can give you a little taste of the good life

- A few banks (namely Chase, Amex, Citi, US Bank) go above and beyond the requirements of the MLA and waive annual fees on premium credit cards for service members

- That includes some premium credit cards such as the AMEX platinum, Chase Sapphire Reserve and US Bank Altitude Reserve which come with some very sweet benefits

- Benefits like lucrative sign up bonuses, annual dining credits, free hotel nights, and elite travel status

- You and your spouse both qualify so you can double the benefits

Don’t pay more than 6% a year in interest

Thanks to the SCRA, most loans you took out before you were on active duty are capped at 6% interest. Let’s say you got a mortgage for 7.5% before joining the Army. Now that you are in service and since debt was pre-existing when you joined, the SCRA applies. To take advantage of the SCRA, you need to make a request directly to the lender. The request needs to be made in writing and include a copy of your military orders. To comply with the SCRA your mortgage rate should be changed to be no more than 6% from the time you entered service. The SCRA applies very broadly – to mortgages or student loans (after 2008), credit card debt and other personal loans.

It’s worth noting that you still owe whatever money you owed before and 6% isn’t nothing. So don’t go rack up a bunch of debt that you wouldn’t otherwise take on before joining the service. But if you do owe money and you are on active duty, make sure you aren’t paying more than 6% interest. The good news is that the cap applies starting from the time you entered service so if you have been paying more than that, you are likely due a credit. For specific questions or next steps, make sure you go to base legal, who will be able to advise you of specifics.

If you have to move

If you deploy, you won’t have a whole lot of use for your leased car. And if you PCS, you are probably not going to want to keep renting that apartment by your old base. The SCRA allows you to break contracts like residential leases, car leases and cell phone plans penalty-free if you deploy or PCS. Like anything in life, terms and conditions apply so check exactly what your contract says but you usually just need to contact the landlord, lender or service provider and send them a copy of your orders or a letter from your CO.

One thing to watch out for: if you’re trying to break a residential lease, your new duty station has to be more than 35 miles away. I’ve seen guys get burned when they moved in town and the old rental company eventually got around to reading the orders and charged them a hefty penalty for breaking the lease because they determined the SCRA did not apply.

You may be noticing a theme but talk to your base legal officer for any specific questions dealing with SCRA and contracts, they are the experts and get paid to help you in these situations.

If you don’t want to move (legally)

The SCRA is generally about helping you avoid bad stuff but it also provides one benefit that can really help. If you’re ordered to move you… have to move… but you don’t have to change your legal state of residence. So if, for instance, you were living in a state with no state income tax (looking at you, AK, FL, NV, NH, SD, TN, TX, WA & WY), you can remain a state resident for tax purposes. Or, if you live in a state with a good state college and you want to keep that in-state tuition.

Go see your admin/finance department who should be able to help you fill out a DD form 2058 to make it official.

Now for the good stuff

The letter of the MLA limits interest and fees that servicemembers and their dependents pay on debt (including credit cards) taken out while on active duty to the military annual percentage rate (MAPR). The MAPR is 36% which is still really high and not a good deal at all. But here’s why we love the MLA – some banks like American Express, Chase, Citi and US Bank go above and beyond and waive the annual fees on their credit cards for military families.

This allows you to get primo cards like the Amex Platinum, Chase Sapphire Reserve or US Bank Altitude Reserve for no annual fee. It’s worth emphasizing that you will still owe a ton of interest on anything you put on the card and don’t pay off each month. But if you live by the golden rule of never carry credit card debt you can avoid that and get some sweet perks for free. A lot of the top cards come with lucrative sign up bonuses and then give you free airline miles and hotel stays based on how much you spend. Some give you dining credits and rebates on other things. Most give you access to some swanky airport lounges. We’ll have a lot more to say about what you can get with these credit cards in future posts.

Both you and your spouse can each get one of these credit cards without an annual fee which means you can double up on these sorts of perks by adding a player two. (And people wonder why military members get married young…)

Always read the fine print

Before you sign up for a card that would otherwise have an $800 annual fee, double check to make sure that you show up as a covered borrower (and eligible to have the fee waived). The system that banks use to check that you are on active duty is the MLA database

https://mla.dmdc.osd.mil/mla/#/home

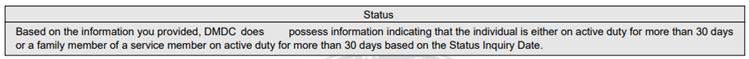

To check, you need to create an account then submit a record request. The record request just requires entering your SSN, last name and date of birth. If you are on active duty or a reservist on orders for longer than 30 days, you should show up in the MLA database. This is what you want to see:

“does not” means abort / do not sign up for any high fee credit cards

“does” means you are good to go

To be continued

I hope this has given you a sense for some of the financial benefits available to service men and women. In future posts, we’ll give into the specifics of some of the benefits on offer. It might take a bit of work to get those benefits but they’re there and if it were easy, anyone could do it.